As parents, most of us reach a point where the same question keeps coming up: should parents give their children pocket money?

On the surface, it seems simple. But when you look closer, it opens the door to a much bigger issue — how (and when) children actually learn about money.

Kids spend more than a decade in the education system, yet most leave school with little to no understanding of budgeting, saving, or managing their own money. Many reach adulthood without knowing how to plan for a large purchase, avoid unnecessary debt, or even track where their money goes.

That leaves parents in a powerful — and often overlooked — position.

Whether we realise it or not, the financial habits our kids form at home often shape their money behaviour for life. And pocket money, when used intentionally, can be one of the simplest tools for teaching real-world money skills in a low-risk way.

Of course, not everyone agrees.

Some parents worry that pocket money encourages entitlement, laziness, or impulse spending on junk. Others aren’t sure how much to give, what age to start, or whether it should be tied to chores at all.

So, should parents give their children pocket money?

The short answer: yes — but only if it’s done properly.

In this article, we’ll look at:

- The real purpose of pocket money

- Common mistakes parents make

- The pros and cons to consider

- And 14 practical tips to help you use pocket money as a powerful financial teaching tool, not just a handout

Disclosure: I am not a financial advisor. This is general information only. Please seek professional advice before making financial decisions.

💡 Heads up: This post may contain affiliate links, which means I may earn a small commission if you buy something through them (including eBay.com & Amazon Associates) — at no extra cost to you. I only recommend stuff I believe in. See our disclosures here. Thanks for your support!

Why Should Parents Give Their Children Pocket Money?

To Learn that Money is Earned

The biggest lesson we want to teach our kids is that money is earned. I think we all remember Mum or Dad saying to us at least once in our lives, “Money doesn’t just grow on trees, you know!”

Although we would all love it if our bank accounts just magically filled up, the reality is, we need to actually earn our money in this world.

Whether or not you want to pay your kids per task or per week is totally up to you (more on that below). Either way, they are still learning that Mum and Dad aren’t just going to open up their wallets every time the child wants something – the money must be earned.

To Learn Money Management

Okay, so the kids are now learning that money is earned, but what should they actually do with it?

Here’s where you’re going to hand the reins over to your children and give them some freedom to spend their money however they like (within reason). You can certainly set some parameters of what they can and can’t do with the money, but essentially, you want them to feel independent and responsible for their decisions.

If they have their eyes on a special toy, you can take them shopping to buy the toy themselves. Through the process, you can show them how to shop around to get the best price.

Kids Budgeting Skills to Learn:

- Look online for the best price

- Check out the price of the item in a few different stores before buying

- Is it an impulsive buy? Go away and think about it before purchasing

- Is the item out of their price range? See if they can find a cheaper one, or save until they’ve got enough

- Once the money’s gone, it’s gone

To Learn How to Save

One of the biggest life skills that seems to be dying is the ability to save. People are just so used to throwing things onto the credit card or Afterpay, that they actually do not have the willpower to save for things any more.

Well, that’s not going to be my kid or your kid. Saving will be second nature for our kids by the time they leave home, and they will actually enjoy it, not resent it!

This is a lesson in working towards personal goals and celebrating when they are achieved.

Your kids will feel so ‘grown up’ by having their own money to save for something big that they want. And when they do hit their goal, make a huge deal out of it! It’s a massive achievement.

If you really don’t want to see your kids fall into the credit trap as adults, setting them up with the skills to save is imperative.

To Avoid Instant Gratification & Entitlement

Carrying on from the point above about saving up for things, let’s talk about instant gratification.

We are bombarded by advertising that paints many pictures of what we ‘need’ to be loved, accepted, appreciated, successful, happy and so on. Kids are huge targets for advertisers with their spongy, impressionable minds.

Even as adults, it’s so easy to get swept up in wanting something right now and just rushing out to buy it. The thing is, we are never happy. As soon as the purchase is made, our mind almost immediately switches focus to the next shiny thing in line.

This need-want-buy culture is not only extremely damaging to our entire ecosystem, but it’s damaging for our sense of self and our financial situation. It keeps us in a perpetual state of thinking we don’t have enough and always wanting more.

“It’s been proven that when people have to work hard for something, they genuinely appreciate it so much more than if it were just given to them.”

With kids now earning their own money, they don’t need to be constantly on your case about wanting ‘things.’ They are now given the opportunity to budget out their own money and buy those things for themselves. They’re learning that they don’t just instantly get whatever they want.

Ultimately, saving and managing their own money teaches kids about working hard for what they’ve got and truly appreciating it.

To Feel the Joy of Generosity

A bit further down below, we’re going to talk about creating a ‘Give’ jar for your kids. This is where they’ll stash some money purely for donating towards someone or something else.

This is another way to encourage empathy and compassion in kids, rather than entitlement. This may start as a money thing, but the idea is for it to infiltrate throughout your kids’ lives.

If someone trips at the supermarket in front of your kids and spills all their things, what would your kids do? Step over them and keep walking, or stop to make sure they’re okay and help them gather their belongings?

We both want our kids to be the ones who would go over and help them.

Giving your kids the foundation for giving, just out of the goodness of their own hearts, helps to send more compassionate people out into the world.

Kids feel so empowered by being able to give some of their earnings away to help someone else. My daughter is currently saving money in her ‘Give’ jar to go to an animal shelter.

To Appreciate What Things Cost

My daughter loves having a Boost Juice as a treat, which I would indulge in on occasion. But, now that she’s ‘earning’ her own money, that’s something she can choose to pay for out of her ‘Splurge’ jar. It’s only now that she is really starting to understand the value behind a $7.90 drink!

Kids may see the price tag of an item, but they have nothing to gauge that figure against if they’ve never had to manage their own money.

Not only will it help them appreciate their own money, but it will help them appreciate yours as well.

If my kids see me comparing prices between items on the shelf at the supermarket, they will actually help find the cheapest price/best value for money. If I say that we’ve got a $10 budget for dinner, they actually get it now.

To Make Mistakes

With cash flow comes responsibility and independence. So, again, we ask the question, should parents give their children pocket money?

Yeah, sure, little Tommy probably is going to blow his whole first pay on lollies. He might be chuffed with his decision (and full belly), or he might then feel sad that he’s got no money left. The point is, let them make the money mistakes early on.

Blowing $10 on lollies is better than blowing their whole income as adults and having to learn the lessons the hard way.

They need to learn how to save, stretch their money until the next ‘pay day,’ shop around for the best deal and be wise with what they’ve got.

Monkey See, Monkey Do: Modelling Good Money Habits

Let’s be honest, kids will listen to some of the stuff parents say… but there’s plenty that they won’t listen to! However, you can bet your bottom dollar that kids will imitate what they see. It’s a subconscious thing that just happens.

Make sure your kids are seeing positive money skills such as:

- Saving for things

- Having occasional splurges

- Comparing prices for the best value

- Waiting until things go on special

- Not using a credit card

- Having different accounts to allocate money for different expenses/goals

- Paying bills on time

- Writing and sticking to a shopping list when doing the groceries

Instilling an Abundance Mindset Rather Than Scarcity

One of the biggest subconscious money beliefs many of us had instilled in us as youngsters is one of scarcity. It’s been running through the generations for eons.

You know the old, “I can’t afford it!”

Instead of saying to our kids that we can’t afford something, how about we flip it around and share the choices that we’re making? We could have a conversation with the kids about how that thing is not a priority right now, or that we need to focus our finances on other things first.

Give the kids options when they ask for something that you don’t have the money for or just don’t want to shell out for. Suggest that they put the item on their birthday or Christmas list. Otherwise, they can save for that item themselves.

It’s all about education and having open and honest conversations surrounding money. I mean, you don’t need to lay your entire financial situation on the table for the kids to see, but it doesn’t need to be strictly taboo either.

Despite common belief, we don’t need to be millionaires to be happy. It’s about accepting your financial situation and making conscious choices to change it and make it better if you’re struggling. That’s what the kids need to see! These are all useful real-life skills that will be added to their own financial toolboxes.

How to Pay Pocket Money

There are a few different schools of thought when it comes to how to pay the kids their pocket money (and in what form). Whichever methods you go for are totally up to you, there is no right or wrong, but here are few options to consider.

Money Jars

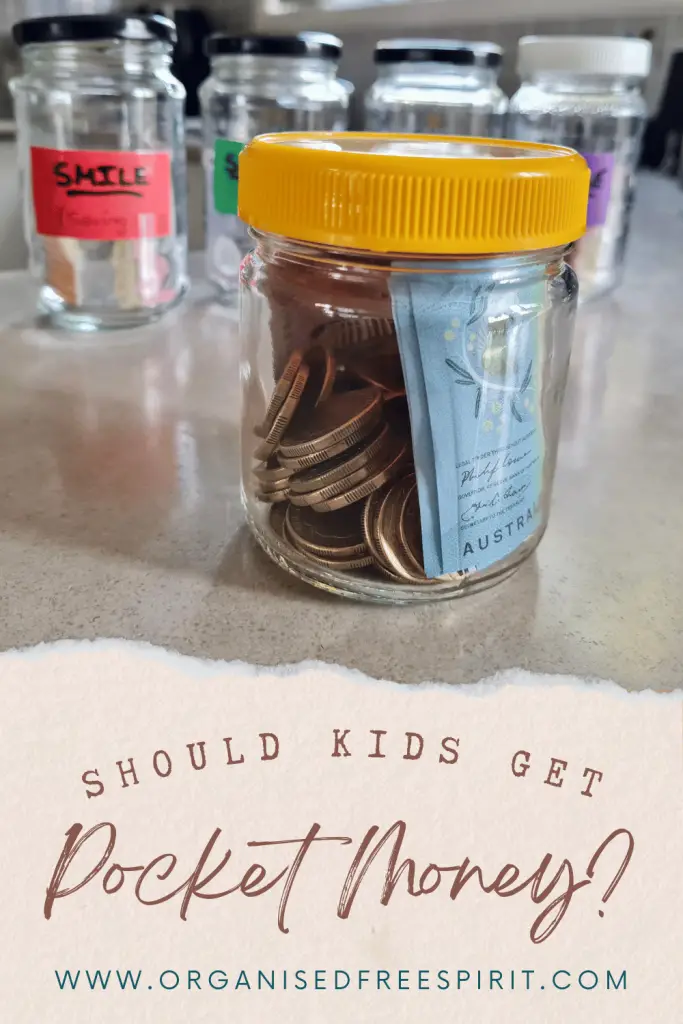

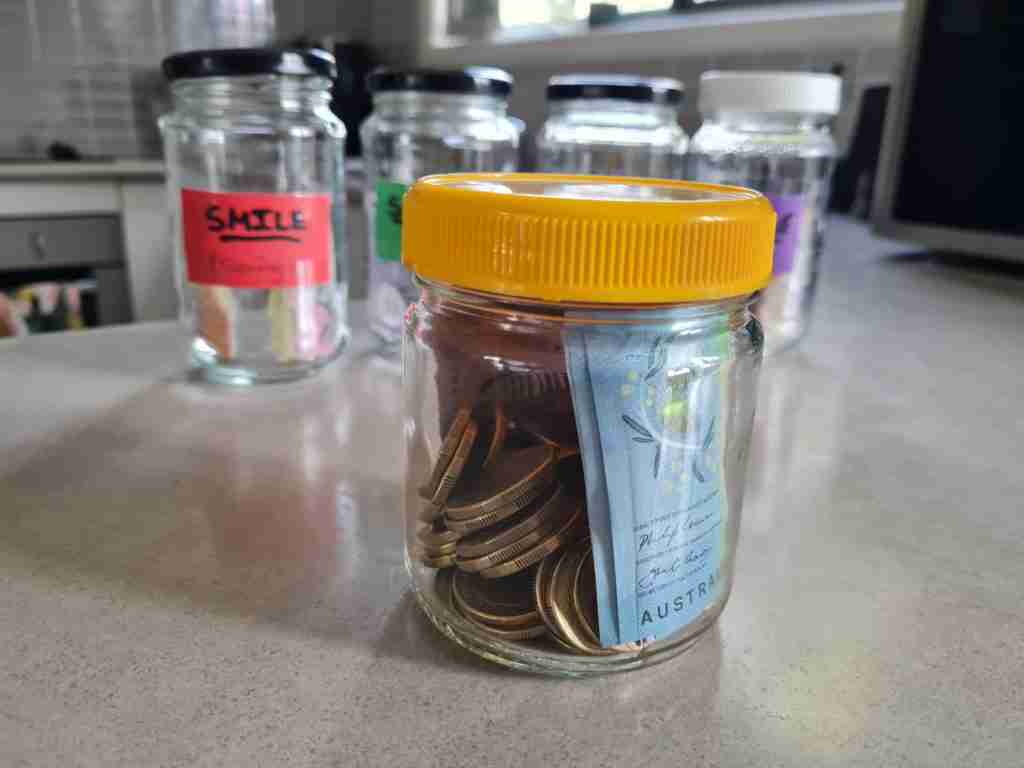

Let’s kick this off with the Barefoot Investor money jam jars.

Money jars are basically the kids’ version of accounts. But, since kids learn way better by touching, seeing and doing, physical jars act as a great money management tool.

The idea is to create three different ‘buckets’ for the kids to divvy their money up into.

Grab three empty jars (per child) and label them:

- SPLURGE – For everyday spendings (clothes, ice cream, online subscriptions, movies)

- SAVINGS – For more expensive or larger goals

- GIVE – To give to a charity, community cause or someone in need

By using money jars for their pocket money, the kids are able to learn the importance of allocating money for different goals or expenses instead of just throwing it all in their wallet and hoping for the best.

The conscious act of choosing where their money goes and seeing it grow really will set them up to be financially responsible adults.

They are learning that money management will help them achieve goals, enjoy the everyday moments and be responsible for their money situation.

Paying Per Chore

Right now, I’m doing the ‘pay per chore’ system, and it’s working really well for my two kids. I really wanted to instil that the more active effort you put in, the more you get paid.

The kids and I came up with a whole heap of tasks that they could get paid for and stuck the list on the fridge. I actually pay them at the time that each task is complete (after passing my inspection).

Benefit: The more they work, the more they earn.

The cost of each task in my house is $1, except washing the car – that’s a $5 task. I’ve explained to the kids that some tasks take longer than others, but it all works out. For example, sweeping out the garage may take 5-10 minutes, while emptying the bins may only take 2 minutes. But there are a variety of tasks available for the taking if they want to earn money!

There are also things that they need to do around the house that they won’t get paid for – they’re just part of living. A good example is to rinse their dishes after eating and put them straight into the dishwasher.

Good chores for kids:

- Make their bed & clean the room

- Take rubbish out to the garbage bin

- Sweep the garage or verandah

- Water the plants

- Feed the pets

- Empty the dishwasher

- Wash & dry dishes

- Hang out/ pull in washing

- Help put groceries away

- Set the table for dinner/ clean up after dinner

- Clean the bathroom

- Vacuum the floors

- Dusting

I know what you’re thinking, “I never have that many coins just lying around!” Well, neither do I in this swipe ‘n’ pay society. So, I went to the bank and got a whole stash of $1 coins, plus a few $5 and $10 notes, so that the kids can cash in their coins every so often (which will replenish my coin stock).

Once they get paid, they can put the coin into whichever money jar they choose.

Paying a Set Allowance

Many people prefer to go for the ‘set allowance’ system, which definitely works as well.

Every household member should indeed be contributing to the running of it, kids included. By paying a set allowance, you can set a few weekly chores for the kids to complete.

This instils that if they pitch in around the house, they will get paid at the end of the week.

Benefit: Everybody contributes to running the household.

Payday should always be a set day, so that the kids know what and when to expect it (just like a real payday). This way, they’re able to learn to budget their income efficiently.

How much should you pay?

- Pay what you can afford

- Or, pay per age of the child (e.g. a 7-year-old gets $7 per week)

When to Open a Bank Account?

For older kids, you may be considering opening a bank account. If kids are getting old enough to get a job, then definitely set up a bank account with them. Make sure you do it together so that they can learn about the process.

If your kids make online purchases, especially for gaming and subscriptions (e.g. Xbox Live, Spotify), you might be pondering if their own bank account is the way to go. You can certainly go down that route, particularly if they’re around 12 or older.

If you’re not comfortable with them having a bank account just yet, or feel that they’re too young, don’t feel pressured to do it. They can just pay you out of their ‘Splurge’ jar for their online expense, then you use your card to make the purchase.

It is a good idea to have a bank account per child (attached to your account) for any birthday or Christmas money the kids get. The kids can also give you lump sums from their ‘Savings’ jar, which will all go towards a big savings goal.

Should You Pay Advances?

I would highly advise against paying pocket money in advance, as this would be setting the kids up with a credit mindset.

There’s a saying in my house…

“If you haven’t got the money, don’t spend it!”

The only exception I would make for paying pocket money in advance (on a very rare occasion) is if it’s a time-sensitive issue.

For example, your son wants to go Go-Karting with his mates for one of their birthdays, which has just been organised at the last minute. If this is an activity that should be coming out of pocket money, and you don’t want to see him miss out, you could give him an advance, explaining that it’s a once-off.

Conclusion: Pocket Money as a Teaching Tool

By now, you’re probably feeling inspired to head to the kitchen and dig out a few empty jars to get your kids started with pocket money.

When it’s used intentionally, pocket money is far more than a weekly handout. It’s a simple, low-risk way to teach children real-world money skills while they’re still living at home — where mistakes are small, guidance is constant, and lessons can be repeated again and again.

By earning their money, learning how to divide it up, and deciding what to do with it, children gain practical experience that school rarely provides. They begin to understand that money doesn’t just appear, that choices have consequences, and that saving, spending, and giving all play an important role in a healthy financial life.

To recap, pocket money helps children to:

- Learn that money is earned

- Develop money management skills

- Learn how to save and plan ahead

- Avoid instant gratification and entitlement

- Experience the joy of generosity

- Appreciate what things really cost

- Make mistakes in a safe environment

- Put into practice what they see modelled at home

- Develop an abundance mindset rather than a scarcity mindset

Done right, pocket money isn’t about control or rewards — it’s about empowerment. And the lessons your children learn now have the potential to shape their financial confidence for decades to come.

More on Kids & Money

Pin It